[ad_1]

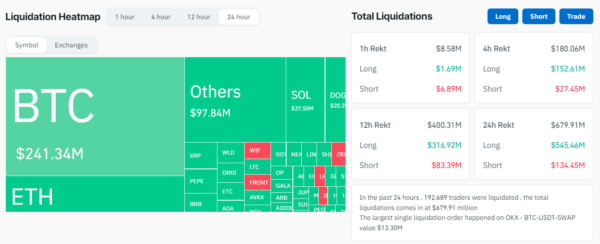

A sharp decline in Bitcoin price has led to over $679 million in crypto trader liquidations, affecting nearly 200,000 traders In the past 24 hours.

This decline, observed on March 15, saw Bitcoin drop 7.5% from $72,000 to $66,500, rebounding briefly to $68,000 before slipping to $67,500. Currently, it sits 8.3% below its recent high of $73,737 on March 14.

Notably, 80% of the liquidated positions were long, amounting to $525.2 million, while shorts lost $136.5 million. The overall crypto market shrank by 7.3%, totaling $2.68 trillion with a $175 billion exit. Greeks Live noted a shift in market momentum, possibly linked to declining ETF inflows.

Pav Hundal from Swyftx suggested a potential correction to $60,000 or $50,000 if ETF volumes continue to drop due to concerns about inflation. Bitcoin ETF inflows decreased by 48% from their 14-day average on March 14, hitting a monthly low of $133 million.

Economic data in the United States, particularly the PPI and CPI data, contributed to the market’s decline, leading to Asian stock market retreats amid dashed hopes for lower interest rates.

The sharp decline in Bitcoin’s price leading to massive liquidations and market shrinkage highlights the vulnerability of crypto markets to economic data and investor sentiment.

Also Read: BlackRock BTC ETF Hits $3.9B Daily Volume Amid Bitcoin Drop

[ad_2]